Menu

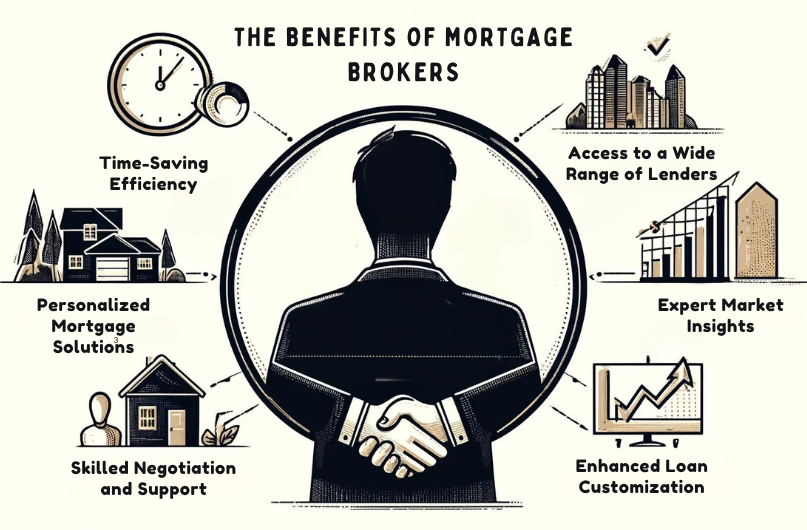

Using a mortgage broker can greatly simplify your home buying process in New Zealand. They handle the communication with lenders, manage all the necessary paperwork, and provide expert advice tailored to your financial situation. Mortgage brokers have access to a wide range of mortgage products and can secure the best deal for you, saving you time and potentially reducing costs. They’re regulated professionals, ensuring transparency and integrity throughout the process. With their in-depth knowledge and industry expertise, brokers guide you through complex mortgage scenarios and advocate on your behalf. Find out more about how a mortgage broker can be a strategic partner in achieving your homeownership goals.

A mortgage broker is a financial expert who helps you navigate through the intricate world of home loans by acting as an intermediary between you and potential lenders. Their qualifications typically include certifications and a strong understanding of financial markets, tailored especially to navigate the diverse mortgage landscape efficiently.

Brokers are subject to stringent industry regulations, ensuring they operate with integrity and transparency. This regulatory framework is designed to protect you by ensuring brokers uphold high standards of practice. As they foster broker relationships with a variety of lenders, they can access a broader array of mortgage products. This means they can offer you tailored options that best meet your financial situation.

Their primary responsibilities involve evaluating your financial circumstances, finding appropriate mortgage options, and assisting throughout the application and settlement processes. This extensive service simplifies your experience, making it less stressful and potentially more cost-effective. By leveraging their expertise, you’re better equipped to make informed decisions in securing the most advantageous mortgage deal.

When you choose to work with a mortgage broker in New Zealand, you’re not just gaining a professional ally; you’re also accessing a vast array of loan products that mightn’t be available through traditional banks. They’re legally required to find you the best deal, ensuring that your financial interests are always the top priority.

Additionally, brokers can greatly reduce the time and effort you need to invest in the mortgage process, guiding you expertly through even the most complex applications.

Mortgage brokers in New Zealand, regulated by the Financial Markets Authority (FMA), must legally secure the best mortgage deal for you, guaranteeing your interests are prioritized. This legal obligation isn’t just a formality—it’s a significant client advantage that places broker’s accountability at the forefront of their service.

Unlike banks, whose primary aim might be to sell their own products, your broker’s duty is aligned with your financial benefits. This framework of consumer protection ensures you aren’t simply settling for a convenient option but are getting the most advantageous deal available.

This commitment to your financial well-being is crucial in navigating the often-complex landscape of mortgage options, giving you peace of mind and potentially saving you a significant amount of money.

A mortgage broker can provide you with an extensive selection of products from various lenders, greatly enhancing your options for securing the best mortgage tailored to your needs. By engaging in thorough market research, they can offer you a detailed product comparison, laying out the pros and cons of each option.

This range of lender options guarantees you aren’t limited to the offerings of a single financial institution. Instead, you receive tailored advice that aligns with your unique financial circumstances and goals. Brokers’ deep understanding of diverse financial solutions translates into optimized mortgage strategies for you.

Their expertise allows them to navigate the complexities of mortgage products, ensuring you make an informed decision that benefits your long-term financial health.

By choosing to work with a mortgage broker in New Zealand, you’ll greatly reduce the time and effort needed to sift through numerous mortgage options on your own. This choice offers significant time-saving benefits and efficiency advantages, streamlining your path to the right mortgage. Here’s how a broker simplifies the process:

Mortgage brokers turn a challenging task into a manageable journey.

Engaging a mortgage broker offers you expert advice and personalized service that’s tailored to your unique financial situation. Brokers possess deep industry knowledge, enabling them to illuminate the path through an array of financial options, ensuring you understand every step.

For first-time buyers or those in intricate financial scenarios, this guidance is invaluable. They provide customized solutions that resonate with your specific needs, making complex decisions simpler.

Dealing with intricate mortgage applications often requires expert assistance, and mortgage brokers are ideally positioned to help. When you’re maneuvering through complex financial waters, such as leveraging KiwiSaver funds or involving family contributions, brokers offer invaluable support through their financial expertise. Here’s how they can assist you:

Utilize a broker’s skills to improve your chances of securing the right mortgage.

One of the most appealing advantages of working with a mortgage broker is that their services are typically free for you, as they earn their commission directly from the lender. This setup not only facilitates cost savings but also boosts your financial freedom.

By leveraging their expert advice, you’re tapping into deep market knowledge without the burden of additional fees. Brokers provide personalized service, tailoring their approach to meet your specific financial circumstances and goals. Their expertise allows them to navigate complex market conditions, ensuring that you receive the best possible terms on your mortgage.

Essentially, choosing a broker can lead to significant savings and a smoother, more efficient mortgage process, allowing you to focus on achieving your home ownership dreams.

Beyond securing your initial mortgage, a skilled broker offers invaluable support managing your loan through changing economic landscapes and personal circumstances. As your financial situation evolves, your broker can guide you through options that best suit your needs. Here’s how they assist:

Utilize their expertise to make sure your mortgage continues to work for you.

Buying a home is likely to be one of the biggest financial decisions you’ll make. And in New Zealand’s dynamic property market, getting expert advice from a mortgage broker can be invaluable in securing the right home loan for your needs. But with hundreds of mortgage brokers out there, how do you choose the right one? Here are some key factors to consider:

It’s also wise to look for a broker with several years of experience in the New Zealand mortgage market. The lending landscape is constantly changing, so you want someone who keeps up with the latest products, interest rates, regulations and trends to give you well-informed advice.

Ideally, look for a broker who can access at least 10-15 different banks and non-bank lenders, including the major players like ANZ, ASB, BNZ and Westpac. This will give you a wider selection of loan options. Keep in mind though that brokers can’t access every lender – for example, Kiwibank only offers home loans directly.

Consider your own situation and whether a broker has dealt with similar borrowers before. A first home buyer has very different needs to an experienced investor expanding their portfolio, for instance. The more a broker understands your specific circumstances, the better they can assist you.

Look for a broker who offers your preferred communication methods, whether that’s face-to-face meetings, phone calls, email or text. And make sure they have the capacity to give your application the attention it deserves – an overloaded broker may not be as proactive as you need.

You can also check a broker’s membership in professional bodies like the New Zealand Mortgage Brokers Association or the New Zealand Financial Advice Network. These organizations have codes of conduct that require members to act with integrity and professionalism.

Always ask upfront about a broker’s fee and commission structures so you know what to expect. Keep in mind that brokers are legally required to disclose any commissions they receive and act in your best interests when recommending a loan, thanks to the recent changes under the Financial Services Legislation Amendment Act.

Choosing the right mortgage broker is a decision that can have a long-term impact on your finances. By considering factors like qualifications, lender panel, specialization, service, reputation and fees, you’ll be well placed to find a broker who can help you navigate New Zealand’s mortgage market with expertise and care.

To guarantee you’re making the best decision, ask your mortgage broker these essential questions during your initial consultation.

These questions will help you assess the broker’s capabilities and commitment to client satisfaction, guiding you to make an informed decision tailored to your needs.

Deciding whether to use a mortgage broker depends heavily on your specific financial circumstances and personal preferences. Evaluating your borrower needs against the broker benefits can offer clarity. A broker’s role is to serve as your advocate, guiding through the complexities of the mortgage process. They can source multiple loan options, helping to secure terms that might be more favorable than what you could find on your own.

The broker services extend beyond merely finding rates; they provide personalized guidance and support, handling paperwork and negotiations. This can be particularly advantageous if you’re pressed for time or unfamiliar with the financial intricacies of loan agreements. Borrower benefits also include the potential for cost savings on interest rates and fees, as brokers have access to a broader array of products than a single lender might offer.

However, weigh these advantages against the cons. Brokers may have fees that could offset the savings achieved on your mortgage. It’s important to ask questions and seek clarification to make sure their services align with your financial goals. Don’t hesitate to compare the terms from direct lenders alongside those your broker presents. This informed approach will help you make a decision that best suits your financial landscape.

Mortgage broker fees typically include service charges, broker compensation, and upfront costs. Fee structures vary, offering different payment options. You’ll find this flexibility aligns with your financial planning for securing the best mortgage terms.

Yes, mortgage brokers can negotiate loan terms. They leverage lender relationships and rate comparisons to devise customized strategies, enhancing your approval odds and potentially reducing your closing costs. It’s a strategic move for your financing.

Mortgage brokers provide tailored solutions after a thorough credit analysis. They’ll offer broker advice on credit improvement and connect you with a variety of lenders best suited to handle your specific credit issues.

Yes, mortgage brokers are regulated and licensed. They must meet strict broker training requirements, undergo compliance audits, and renew their licenses regularly, ensuring they stay accredited by recognized regulatory bodies.

If you’re unhappy with your broker’s service, explore broker replacement options, understand service dissatisfaction causes, and learn complaint filing procedures. Evaluate brokers against set criteria and consider alternative service sources for better satisfaction.

To sum up, a mortgage broker can be your gateway to better loan options with less hassle. They’ll navigate the complex mortgage landscape, guaranteeing you secure the best rates and terms suited to your needs.

When choosing a broker, inquire about their experience, fees, and lender options to establish transparency and trust. Ultimately, using a mortgage broker could save you time and money, making it a prudent choice for your financial future.

Consider your needs and make an informed decision.