Menu

Choosing the right mortgage broker can make all the difference in securing the best deal for your home loan. Whether you’re a first-time homebuyer, looking to refinance, or simply exploring your mortgage options, a good mortgage broker can save you time, effort, and money. However, not all mortgage brokers are created equal. With so many options available in New Zealand, it’s crucial to choose one that fits your needs, offers excellent service, and has the expertise to navigate the complexities of the mortgage market.

In this blog post, we’ll walk you through five essential questions you should ask before choosing a mortgage broker to ensure that you’re making an informed decision. At Best Mortgage Brokers, we’re dedicated to helping Kiwis find the best mortgage solutions for their financial goals. By understanding the right questions to ask, you’ll feel confident in choosing a mortgage broker that can guide you through the home-buying process with ease.

When it comes to choosing a mortgage broker, experience matters. A broker with a strong understanding of the New Zealand property and finance markets will have the expertise to help you navigate the various loan products, interest rates, and lending criteria available.

Why It Matters:

The New Zealand mortgage landscape can be complex, with various lenders offering different types of loans, conditions, and rates. Additionally, the Reserve Bank of New Zealand (RBNZ) has specific regulations and lending restrictions that can influence your loan eligibility, especially when it comes to Loan-to-Value Ratio (LVR) and other criteria.

An experienced mortgage broker will be familiar with these nuances and be able to advise you on the best mortgage options based on your financial circumstances, property type, and goals. They should also have a strong track record of successfully securing mortgages for clients in your situation, whether you’re a first-time homebuyer, looking to refinance, or need a low-deposit loan.

What to Ask:

One of the main reasons people choose to work with a mortgage broker is their access to a variety of lenders. Unlike a bank or a single lender, brokers have access to multiple lending institutions, including big banks, credit unions, and non-bank lenders. This increases the chances of finding a mortgage that best suits your needs.

Why It Matters:

Different lenders have different loan products, interest rates, and lending criteria. If you only go directly to a bank, you might miss out on more competitive rates or suitable products from other lenders. A broker who works with a wide range of lenders can present you with multiple options, ensuring that you get the best deal possible.

Additionally, brokers may have access to exclusive deals, special rates, or products that aren’t available directly to the public. This can be particularly useful if you have specific circumstances, such as a low deposit or a less-than-perfect credit history, that may limit your options.

What to Ask:

Mortgage brokers typically earn a commission from lenders when they successfully secure a loan for you. However, it’s important to understand how a broker is compensated and whether there are any fees you’ll need to pay for their services.

Why It Matters:

A transparent mortgage broker will be upfront about their fee structure and how they get paid. Some brokers charge a fee to clients for their services, while others only get paid by the lender. Knowing this will help you assess the true cost of using a broker and ensure that their interests align with yours.

If a broker is paid by the lender, it’s important to understand whether they are incentivized to recommend certain lenders over others. A professional and ethical broker should always prioritize your needs and offer unbiased advice, regardless of the lender’s commission structure.

What to Ask:

The mortgage process can be stressful, especially for first-time homebuyers or those unfamiliar with the paperwork and documentation required. A good mortgage broker should offer more than just advice—they should provide ongoing support to ensure the process goes smoothly from start to finish.

Why It Matters:

The mortgage process involves a lot of paperwork, negotiations, and potential delays. A broker should act as a guide and advocate, helping you understand the requirements, answering your questions, and ensuring that all the paperwork is submitted correctly and on time. They should also be available to troubleshoot any issues that may arise during the approval or settlement process.

Additionally, some brokers offer post-settlement services, helping you monitor your mortgage over time and advising you on options for refinancing, repayment strategies, or accessing better deals in the future.

What to Ask:

Trust is crucial when choosing a mortgage broker. One way to ensure you’re working with a reputable and reliable professional is to ask for references or testimonials from previous clients. Positive reviews from other homeowners can provide insight into the broker’s service quality, professionalism, and success rate in securing mortgages.

Why It Matters:

Reading testimonials or hearing from clients who have worked with the broker in the past can help you gauge the level of satisfaction others have experienced. This can give you confidence that the broker is trustworthy, knowledgeable, and capable of handling your mortgage needs.

A reputable mortgage broker should be happy to share client testimonials or even provide you with direct references you can contact for further feedback. This can also help you understand what to expect during your own mortgage journey.

What to Ask:

Choosing the right mortgage broker is an essential step in securing the best mortgage for your home. By asking these five questions, you can ensure that the broker you choose has the expertise, resources, and commitment to helping you achieve your homeownership goals.

At Best Mortgage Brokers, we pride ourselves on offering expert advice, a wide range of mortgage options, and transparent, customer-focused service. Whether you’re buying your first home, refinancing, or looking for the best mortgage rates, we’re here to help you navigate the process with ease.

Ready to take the next step? Contact Best Mortgage Brokers today to find the perfect mortgage solution for you! Our team of experienced brokers is here to help you secure the best home loan deal for your needs and goals.

For New Zealand homeowners and homebuyers, navigating the world of mortgages can feel overwhelming, especially when it comes to industry-specific terms. One critical concept in the mortgage process is the Loan-to-Value (LTV) ratio. Knowing what LTV is, how it affects your mortgage application, and why it’s important can help you make better-informed decisions and increase your chances of securing a favorable loan.

At Best Mortgage Brokers, we are committed to helping New Zealanders understand the factors that can influence their mortgage options. Here’s a detailed look into LTV and its significance.

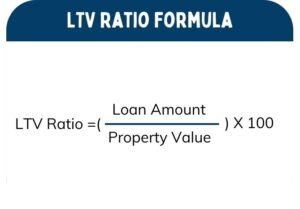

The Loan-to-Value ratio is a calculation used by lenders to assess the risk level of a mortgage loan. It’s the percentage that represents the ratio of the mortgage loan amount to the appraised value or purchase price of the property (whichever is lower). Essentially, it helps lenders understand how much equity you have in the property you’re looking to finance.

Formula for LTV Calculation:

LTV Ratio = (Loan Amount ÷ Property Value) x 100

For instance, if you’re buying a house worth NZ$500,000 and you have a 20% deposit (NZ$100,000), your loan amount would be NZ$400,000. Using the formula, your LTV ratio would be:

Example Values:

Calculation Steps:

Result:

LTV Ratio = 80%

The LTV ratio is crucial for both the lender and the borrower. Here’s why:

The amount you put down as a deposit has a direct effect on your LTV ratio. For example:

Lowering your LTV ratio can lead to better mortgage terms. Here are ways to reduce your LTV:

In New Zealand, if your LTV ratio is above 80%, you may be required to pay mortgage insurance. Mortgage insurance protects the lender in case you default on the loan. While it adds to your costs, it can allow you to buy a home with a smaller deposit, even as low as 10%.

While it’s possible to get approved with a high LTV ratio, aiming for an 80% or lower LTV can offer the best balance between affordability and flexibility. A lower LTV often means a more manageable monthly repayment amount, greater flexibility with lenders, and access to better rates.

Refinancing an existing mortgage is another situation where LTV plays a role. If you’re looking to refinance, having a lower LTV ratio (due to property appreciation or loan repayment over time) can make it easier to qualify for competitive refinancing rates.

A professional mortgage broker, like Best Mortgage Brokers, can help you understand and manage your LTV ratio by advising on ways to improve your deposit, providing options that accommodate higher LTVs, and working with lenders to get you the best possible rate. Mortgage brokers know the local New Zealand market, and they can help you navigate unique scenarios like low deposit loans, first-time buyer options, or refinancing.

LTV is a crucial factor in mortgage decisions and can influence your loan approval, interest rates, and even your overall financial stability. Understanding your LTV ratio, and finding ways to lower it if necessary, can set you up for long-term success and financial health.

If you’re ready to take the next step in your home-buying journey or need assistance with your LTV ratio, reach out to Best Mortgage Brokers. We’re here to help New Zealanders find the best possible mortgage solutions for their financial goals.

When considering a mortgage in New Zealand, one of the first decisions you’ll need to make is whether to choose a fixed or variable rate. Both options have their own advantages and potential drawbacks, and the right choice depends on your financial situation, goals, and risk tolerance. At Best Mortgage Brokers, we understand how important this decision is, so we’ve prepared this guide to help you navigate the differences and benefits of fixed vs. variable rate mortgages.

A fixed rate mortgage locks in a specific interest rate for a set period, typically ranging from one to five years in New Zealand. This rate remains unchanged throughout the term, providing predictable monthly payments.

Understanding Variable Rate Mortgages

Understanding Variable Rate MortgagesA variable rate mortgage, also known as a floating rate mortgage in New Zealand, has an interest rate that can change based on market conditions. Your lender will adjust the rate periodically, so your monthly payments could go up or down.

| Feature | Fixed Rate Mortgage | Variable Rate Mortgage |

|---|---|---|

| Interest Rate | Stays the same for the term | Fluctuates based on market conditions |

| Monthly Payments | Fixed amount | Can increase or decrease |

| Flexibility | Limited; high break fees | High; often no break fees |

| Risk Level | Low risk | Higher risk |

| Ideal For | Budget-conscious borrowers, those seeking stability | Those comfortable with risk, potential savings |

The right mortgage choice depends on your financial goals, lifestyle, and risk tolerance. Consider the following questions to guide your decision:

In New Zealand, many homeowners opt for a split mortgage, combining both fixed and variable rates. This option offers the best of both worlds: the stability of a fixed rate and the potential savings of a variable rate. By splitting your mortgage, you can enjoy partial protection against rate hikes while still benefiting if rates decrease.

The New Zealand mortgage market is influenced by factors such as the RBNZ’s official cash rate, inflation, and the broader economy. Recently, the RBNZ has increased interest rates to control inflation, which may make a fixed rate appealing to those looking for security against future hikes. However, if you believe rates may stabilise or fall, a variable rate could be a cost-saving option in the near future.

Choosing between a fixed and variable rate mortgage is one of the biggest decisions you’ll make when financing a home in New Zealand. Fixed rates offer stability and peace of mind, while variable rates can provide flexibility and potential savings. If you’re unsure which path is best for you, a split mortgage might offer a balanced solution.

At Best Mortgage Brokers, we’re here to help you make the right choice. With our expertise in New Zealand’s mortgage landscape, we can guide you through the options and find the perfect mortgage for your unique needs. Whether you’re a first-time buyer or a seasoned homeowner, our team is committed to helping you achieve your financial goals.