Menu

Choosing the right mortgage broker can make all the difference in securing the best deal for your home loan. Whether you’re a first-time homebuyer, looking to refinance, or simply exploring your mortgage options, a good mortgage broker can save you time, effort, and money. However, not all mortgage brokers are created equal. With so many options available in New Zealand, it’s crucial to choose one that fits your needs, offers excellent service, and has the expertise to navigate the complexities of the mortgage market.

In this blog post, we’ll walk you through five essential questions you should ask before choosing a mortgage broker to ensure that you’re making an informed decision. At Best Mortgage Brokers, we’re dedicated to helping Kiwis find the best mortgage solutions for their financial goals. By understanding the right questions to ask, you’ll feel confident in choosing a mortgage broker that can guide you through the home-buying process with ease.

When it comes to choosing a mortgage broker, experience matters. A broker with a strong understanding of the New Zealand property and finance markets will have the expertise to help you navigate the various loan products, interest rates, and lending criteria available.

Why It Matters:

The New Zealand mortgage landscape can be complex, with various lenders offering different types of loans, conditions, and rates. Additionally, the Reserve Bank of New Zealand (RBNZ) has specific regulations and lending restrictions that can influence your loan eligibility, especially when it comes to Loan-to-Value Ratio (LVR) and other criteria.

An experienced mortgage broker will be familiar with these nuances and be able to advise you on the best mortgage options based on your financial circumstances, property type, and goals. They should also have a strong track record of successfully securing mortgages for clients in your situation, whether you’re a first-time homebuyer, looking to refinance, or need a low-deposit loan.

What to Ask:

One of the main reasons people choose to work with a mortgage broker is their access to a variety of lenders. Unlike a bank or a single lender, brokers have access to multiple lending institutions, including big banks, credit unions, and non-bank lenders. This increases the chances of finding a mortgage that best suits your needs.

Why It Matters:

Different lenders have different loan products, interest rates, and lending criteria. If you only go directly to a bank, you might miss out on more competitive rates or suitable products from other lenders. A broker who works with a wide range of lenders can present you with multiple options, ensuring that you get the best deal possible.

Additionally, brokers may have access to exclusive deals, special rates, or products that aren’t available directly to the public. This can be particularly useful if you have specific circumstances, such as a low deposit or a less-than-perfect credit history, that may limit your options.

What to Ask:

Mortgage brokers typically earn a commission from lenders when they successfully secure a loan for you. However, it’s important to understand how a broker is compensated and whether there are any fees you’ll need to pay for their services.

Why It Matters:

A transparent mortgage broker will be upfront about their fee structure and how they get paid. Some brokers charge a fee to clients for their services, while others only get paid by the lender. Knowing this will help you assess the true cost of using a broker and ensure that their interests align with yours.

If a broker is paid by the lender, it’s important to understand whether they are incentivized to recommend certain lenders over others. A professional and ethical broker should always prioritize your needs and offer unbiased advice, regardless of the lender’s commission structure.

What to Ask:

The mortgage process can be stressful, especially for first-time homebuyers or those unfamiliar with the paperwork and documentation required. A good mortgage broker should offer more than just advice—they should provide ongoing support to ensure the process goes smoothly from start to finish.

Why It Matters:

The mortgage process involves a lot of paperwork, negotiations, and potential delays. A broker should act as a guide and advocate, helping you understand the requirements, answering your questions, and ensuring that all the paperwork is submitted correctly and on time. They should also be available to troubleshoot any issues that may arise during the approval or settlement process.

Additionally, some brokers offer post-settlement services, helping you monitor your mortgage over time and advising you on options for refinancing, repayment strategies, or accessing better deals in the future.

What to Ask:

Trust is crucial when choosing a mortgage broker. One way to ensure you’re working with a reputable and reliable professional is to ask for references or testimonials from previous clients. Positive reviews from other homeowners can provide insight into the broker’s service quality, professionalism, and success rate in securing mortgages.

Why It Matters:

Reading testimonials or hearing from clients who have worked with the broker in the past can help you gauge the level of satisfaction others have experienced. This can give you confidence that the broker is trustworthy, knowledgeable, and capable of handling your mortgage needs.

A reputable mortgage broker should be happy to share client testimonials or even provide you with direct references you can contact for further feedback. This can also help you understand what to expect during your own mortgage journey.

What to Ask:

Choosing the right mortgage broker is an essential step in securing the best mortgage for your home. By asking these five questions, you can ensure that the broker you choose has the expertise, resources, and commitment to helping you achieve your homeownership goals.

At Best Mortgage Brokers, we pride ourselves on offering expert advice, a wide range of mortgage options, and transparent, customer-focused service. Whether you’re buying your first home, refinancing, or looking for the best mortgage rates, we’re here to help you navigate the process with ease.

Ready to take the next step? Contact Best Mortgage Brokers today to find the perfect mortgage solution for you! Our team of experienced brokers is here to help you secure the best home loan deal for your needs and goals.

For New Zealand homeowners and homebuyers, navigating the world of mortgages can feel overwhelming, especially when it comes to industry-specific terms. One critical concept in the mortgage process is the Loan-to-Value (LTV) ratio. Knowing what LTV is, how it affects your mortgage application, and why it’s important can help you make better-informed decisions and increase your chances of securing a favorable loan.

At Best Mortgage Brokers, we are committed to helping New Zealanders understand the factors that can influence their mortgage options. Here’s a detailed look into LTV and its significance.

The Loan-to-Value ratio is a calculation used by lenders to assess the risk level of a mortgage loan. It’s the percentage that represents the ratio of the mortgage loan amount to the appraised value or purchase price of the property (whichever is lower). Essentially, it helps lenders understand how much equity you have in the property you’re looking to finance.

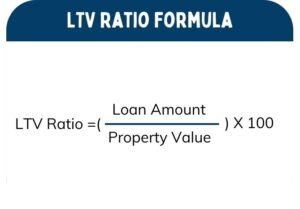

Formula for LTV Calculation:

LTV Ratio = (Loan Amount ÷ Property Value) x 100

For instance, if you’re buying a house worth NZ$500,000 and you have a 20% deposit (NZ$100,000), your loan amount would be NZ$400,000. Using the formula, your LTV ratio would be:

Example Values:

Calculation Steps:

Result:

LTV Ratio = 80%

The LTV ratio is crucial for both the lender and the borrower. Here’s why:

The amount you put down as a deposit has a direct effect on your LTV ratio. For example:

Lowering your LTV ratio can lead to better mortgage terms. Here are ways to reduce your LTV:

In New Zealand, if your LTV ratio is above 80%, you may be required to pay mortgage insurance. Mortgage insurance protects the lender in case you default on the loan. While it adds to your costs, it can allow you to buy a home with a smaller deposit, even as low as 10%.

While it’s possible to get approved with a high LTV ratio, aiming for an 80% or lower LTV can offer the best balance between affordability and flexibility. A lower LTV often means a more manageable monthly repayment amount, greater flexibility with lenders, and access to better rates.

Refinancing an existing mortgage is another situation where LTV plays a role. If you’re looking to refinance, having a lower LTV ratio (due to property appreciation or loan repayment over time) can make it easier to qualify for competitive refinancing rates.

A professional mortgage broker, like Best Mortgage Brokers, can help you understand and manage your LTV ratio by advising on ways to improve your deposit, providing options that accommodate higher LTVs, and working with lenders to get you the best possible rate. Mortgage brokers know the local New Zealand market, and they can help you navigate unique scenarios like low deposit loans, first-time buyer options, or refinancing.

LTV is a crucial factor in mortgage decisions and can influence your loan approval, interest rates, and even your overall financial stability. Understanding your LTV ratio, and finding ways to lower it if necessary, can set you up for long-term success and financial health.

If you’re ready to take the next step in your home-buying journey or need assistance with your LTV ratio, reach out to Best Mortgage Brokers. We’re here to help New Zealanders find the best possible mortgage solutions for their financial goals.

For New Zealanders with low credit scores, obtaining a home loan might seem like a distant dream, but there are options available. A lower credit score can make lenders hesitant; however, understanding how to approach the mortgage process and exploring alternative lending options can make a difference. Here, we’ll cover the essentials of getting a home loan with a low credit score, the factors that lenders consider, and tips to improve your odds of approval.

Your credit score plays a crucial role in the lending process, as it’s often one of the first factors that lenders assess when deciding on a loan application. A credit score reflects your credit history, reliability, and overall financial health. Typically, a score of 700 and above is considered strong in New Zealand, but those with scores below this may face challenges when applying for loans.

Lenders may hesitate to approve a loan or may offer higher interest rates to offset the risk associated with a low credit score. The good news is that a low score doesn’t necessarily mean you’re out of options—it simply requires a more strategic approach.

While credit score is important, it’s not the only factor lenders consider. Here are other critical elements that may work in your favor, even if your credit score is less than ideal:

If you’re looking for a home loan but have a low credit score, consider these options:

Traditional banks may be more rigid in their lending criteria, but specialist or non-bank lenders are often more flexible. These lenders may be willing to take on higher-risk clients, albeit with higher interest rates. Some of the popular non-bank lenders in New Zealand include Resimac, Liberty, and Pepper Money. Research their terms and interest rates to find one that works for you.

The Kāinga Ora First Home Loan is designed to help New Zealanders with low to moderate incomes become homeowners. If your credit score is low but you meet the income requirements, this may be a great option to explore. The program also requires a minimal deposit, often as low as 5%, and may be accessible with less stringent credit checks than conventional loans.

Family members might be able to provide financial assistance for a deposit or act as guarantors. This option doesn’t directly address the low credit score but can provide assurance to lenders that the borrower has support.

Shared equity programs allow you to co-own a portion of the property with a third party, typically a government body or nonprofit organization, which reduces the amount you need to borrow. By lowering your loan amount, you may appear more favorable to lenders despite a lower credit score.

If your credit score limits you from accessing a full home loan, consider taking a smaller personal loan to increase your deposit. While personal loans often carry higher interest rates, a larger down payment can improve your home loan application by reducing the loan-to-value ratio.

New Zealand’s peer-to-peer lending platforms allow individuals to borrow directly from investors, sometimes with more flexible criteria than banks. While still requiring a minimum credit score, peer-to-peer lenders may focus more on other aspects, like income and employment stability.

Yes, while challenging, some non-bank lenders or specialist lenders may consider applicants with no credit history, focusing on other factors like income and savings.

Yes, a higher deposit can make a lender more comfortable as it lowers the overall risk. Aim for a 20% deposit if possible, though some lenders may accept less.

To improve your credit score, focus on timely bill payments, paying off existing debt, and limiting new credit applications. Over time, these habits can raise your score.

Obtaining a mortgage with a low credit score is certainly more challenging but not impossible. By understanding the available options and making an effort to present a strong overall application, you can improve your chances of success. Each borrower’s situation is unique, so taking the time to evaluate the various pathways and seeking professional guidance can make a significant difference in reaching your homeownership goals.

For more tailored advice and help finding the right mortgage lender, contact Best Mortgage Brokers today. Our team of specialists can guide you through the process and connect you with lenders who understand unique financial situations. Let us help make homeownership a reality for you!

When considering a mortgage in New Zealand, one of the first decisions you’ll need to make is whether to choose a fixed or variable rate. Both options have their own advantages and potential drawbacks, and the right choice depends on your financial situation, goals, and risk tolerance. At Best Mortgage Brokers, we understand how important this decision is, so we’ve prepared this guide to help you navigate the differences and benefits of fixed vs. variable rate mortgages.

A fixed rate mortgage locks in a specific interest rate for a set period, typically ranging from one to five years in New Zealand. This rate remains unchanged throughout the term, providing predictable monthly payments.

Understanding Variable Rate Mortgages

Understanding Variable Rate MortgagesA variable rate mortgage, also known as a floating rate mortgage in New Zealand, has an interest rate that can change based on market conditions. Your lender will adjust the rate periodically, so your monthly payments could go up or down.

| Feature | Fixed Rate Mortgage | Variable Rate Mortgage |

|---|---|---|

| Interest Rate | Stays the same for the term | Fluctuates based on market conditions |

| Monthly Payments | Fixed amount | Can increase or decrease |

| Flexibility | Limited; high break fees | High; often no break fees |

| Risk Level | Low risk | Higher risk |

| Ideal For | Budget-conscious borrowers, those seeking stability | Those comfortable with risk, potential savings |

The right mortgage choice depends on your financial goals, lifestyle, and risk tolerance. Consider the following questions to guide your decision:

In New Zealand, many homeowners opt for a split mortgage, combining both fixed and variable rates. This option offers the best of both worlds: the stability of a fixed rate and the potential savings of a variable rate. By splitting your mortgage, you can enjoy partial protection against rate hikes while still benefiting if rates decrease.

The New Zealand mortgage market is influenced by factors such as the RBNZ’s official cash rate, inflation, and the broader economy. Recently, the RBNZ has increased interest rates to control inflation, which may make a fixed rate appealing to those looking for security against future hikes. However, if you believe rates may stabilise or fall, a variable rate could be a cost-saving option in the near future.

Choosing between a fixed and variable rate mortgage is one of the biggest decisions you’ll make when financing a home in New Zealand. Fixed rates offer stability and peace of mind, while variable rates can provide flexibility and potential savings. If you’re unsure which path is best for you, a split mortgage might offer a balanced solution.

At Best Mortgage Brokers, we’re here to help you make the right choice. With our expertise in New Zealand’s mortgage landscape, we can guide you through the options and find the perfect mortgage for your unique needs. Whether you’re a first-time buyer or a seasoned homeowner, our team is committed to helping you achieve your financial goals.

Purchasing a home is one of the most significant financial decisions you’ll make in your lifetime. Whether you’re a first-time homebuyer or refinancing your existing mortgage, securing a mortgage in New Zealand can be a complex and daunting process. While many are excited about the prospect of homeownership, mistakes in the mortgage application process can delay approval or, worse, lead to rejection. Understanding and avoiding these common pitfalls will help you streamline the process and ensure you get the best deal.

By being aware of these missteps, you can make informed decisions and increase your chances of a smooth and successful mortgage application process.

Your credit score is one of the most important factors that lenders use to determine your eligibility for a mortgage. It’s essentially a reflection of your financial health, showing how responsible you’ve been with managing credit and debt. The higher your credit score, the more favorable your mortgage terms will be, including lower interest rates.

However, many homebuyers in New Zealand fail to check their credit score before applying for a mortgage. This is a critical mistake because any issues with your credit report could negatively impact your ability to secure a loan. For example, outstanding debts, missed payments, or even errors on your credit report can lower your score and affect your mortgage approval chances.

Having a good credit score demonstrates to lenders that you’re a low-risk borrower, which means they’re more likely to approve your application and offer you better loan terms.

Many first-time buyers make the mistake of accepting the first mortgage offer they receive. However, mortgage rates can vary significantly across lenders, and even a small difference in interest rates can have a huge impact on your long-term payments.

New Zealand’s mortgage market offers a variety of options, from fixed-rate to floating-rate loans. Failing to shop around for the best rates could result in you paying more over the life of the loan.

Securing a mortgage with a competitive interest rate can save you thousands of dollars over the life of your loan. It’s worth investing time in comparing offers to ensure you get the most affordable option for your needs.

In New Zealand, most lenders require a deposit or equity as part of the mortgage application process. This deposit represents your share of the home’s value and is typically between 10% to 20% of the purchase price, although some lenders may accept as low as 5% for certain buyers (such as first-time homebuyers or those with a good credit history).

Many applicants make the mistake of underestimating the importance of having a solid deposit saved up. A small deposit could limit your mortgage options and lead to higher interest rates. On the other hand, a larger deposit will demonstrate your ability to manage money and may result in a lower loan-to-value ratio (LVR), improving your chances of mortgage approval.

A substantial deposit reduces the amount you need to borrow, which can improve your chances of securing a mortgage with favorable terms. It can also help you avoid costly LVR restrictions and Lender’s Mortgage Insurance (LMI) fees.

Your debt-to-income ratio (DTI) is a key factor that lenders use to assess your ability to manage additional debt. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. A high DTI ratio means that you’re already carrying a large amount of debt relative to your income, which can raise red flags for lenders.

Lenders in New Zealand typically prefer a DTI of 40% or lower when considering mortgage applications. If your DTI is too high, it can hinder your chances of getting approved for a mortgage, or result in you being offered a smaller loan amount.

Keeping your debt-to-income ratio low shows lenders that you have the financial capacity to handle additional debt and can make your mortgage repayments on time. This makes you a more attractive candidate for loan approval.

One of the most common mistakes is not being completely transparent about your financial situation when applying for a mortgage. Lenders rely on accurate and complete information to assess your application, and any discrepancies or hidden debts could result in delays, denials, or even legal consequences.

Honesty and transparency ensure that your mortgage application is processed efficiently. Lenders will appreciate your openness, which can lead to a quicker approval and more favorable loan terms.

The process of applying for a mortgage in New Zealand can seem overwhelming, but with the right preparation and knowledge, you can avoid the common mistakes that often lead to delays or rejection. By checking your credit score, shopping around for the best rates, understanding the importance of a solid deposit, keeping your debt-to-income ratio low, and being transparent with your lender, you’ll increase your chances of securing the right mortgage for your needs.

If you’re ready to begin the mortgage application process or need expert advice, Best Mortgage Brokers is here to help. We can guide you through each step, ensuring you avoid these common pitfalls and secure the best deal possible.

Using a mortgage broker can greatly simplify your home buying process in New Zealand. They handle the communication with lenders, manage all the necessary paperwork, and provide expert advice tailored to your financial situation. Mortgage brokers have access to a wide range of mortgage products and can secure the best deal for you, saving you time and potentially reducing costs. They’re regulated professionals, ensuring transparency and integrity throughout the process. With their in-depth knowledge and industry expertise, brokers guide you through complex mortgage scenarios and advocate on your behalf. Find out more about how a mortgage broker can be a strategic partner in achieving your homeownership goals.

A mortgage broker is a financial expert who helps you navigate through the intricate world of home loans by acting as an intermediary between you and potential lenders. Their qualifications typically include certifications and a strong understanding of financial markets, tailored especially to navigate the diverse mortgage landscape efficiently.

Brokers are subject to stringent industry regulations, ensuring they operate with integrity and transparency. This regulatory framework is designed to protect you by ensuring brokers uphold high standards of practice. As they foster broker relationships with a variety of lenders, they can access a broader array of mortgage products. This means they can offer you tailored options that best meet your financial situation.

Their primary responsibilities involve evaluating your financial circumstances, finding appropriate mortgage options, and assisting throughout the application and settlement processes. This extensive service simplifies your experience, making it less stressful and potentially more cost-effective. By leveraging their expertise, you’re better equipped to make informed decisions in securing the most advantageous mortgage deal.

When you choose to work with a mortgage broker in New Zealand, you’re not just gaining a professional ally; you’re also accessing a vast array of loan products that mightn’t be available through traditional banks. They’re legally required to find you the best deal, ensuring that your financial interests are always the top priority.

Additionally, brokers can greatly reduce the time and effort you need to invest in the mortgage process, guiding you expertly through even the most complex applications.

Mortgage brokers in New Zealand, regulated by the Financial Markets Authority (FMA), must legally secure the best mortgage deal for you, guaranteeing your interests are prioritized. This legal obligation isn’t just a formality—it’s a significant client advantage that places broker’s accountability at the forefront of their service.

Unlike banks, whose primary aim might be to sell their own products, your broker’s duty is aligned with your financial benefits. This framework of consumer protection ensures you aren’t simply settling for a convenient option but are getting the most advantageous deal available.

This commitment to your financial well-being is crucial in navigating the often-complex landscape of mortgage options, giving you peace of mind and potentially saving you a significant amount of money.

A mortgage broker can provide you with an extensive selection of products from various lenders, greatly enhancing your options for securing the best mortgage tailored to your needs. By engaging in thorough market research, they can offer you a detailed product comparison, laying out the pros and cons of each option.

This range of lender options guarantees you aren’t limited to the offerings of a single financial institution. Instead, you receive tailored advice that aligns with your unique financial circumstances and goals. Brokers’ deep understanding of diverse financial solutions translates into optimized mortgage strategies for you.

Their expertise allows them to navigate the complexities of mortgage products, ensuring you make an informed decision that benefits your long-term financial health.

By choosing to work with a mortgage broker in New Zealand, you’ll greatly reduce the time and effort needed to sift through numerous mortgage options on your own. This choice offers significant time-saving benefits and efficiency advantages, streamlining your path to the right mortgage. Here’s how a broker simplifies the process:

Mortgage brokers turn a challenging task into a manageable journey.

Engaging a mortgage broker offers you expert advice and personalized service that’s tailored to your unique financial situation. Brokers possess deep industry knowledge, enabling them to illuminate the path through an array of financial options, ensuring you understand every step.

For first-time buyers or those in intricate financial scenarios, this guidance is invaluable. They provide customized solutions that resonate with your specific needs, making complex decisions simpler.

Dealing with intricate mortgage applications often requires expert assistance, and mortgage brokers are ideally positioned to help. When you’re maneuvering through complex financial waters, such as leveraging KiwiSaver funds or involving family contributions, brokers offer invaluable support through their financial expertise. Here’s how they can assist you:

Utilize a broker’s skills to improve your chances of securing the right mortgage.

One of the most appealing advantages of working with a mortgage broker is that their services are typically free for you, as they earn their commission directly from the lender. This setup not only facilitates cost savings but also boosts your financial freedom.

By leveraging their expert advice, you’re tapping into deep market knowledge without the burden of additional fees. Brokers provide personalized service, tailoring their approach to meet your specific financial circumstances and goals. Their expertise allows them to navigate complex market conditions, ensuring that you receive the best possible terms on your mortgage.

Essentially, choosing a broker can lead to significant savings and a smoother, more efficient mortgage process, allowing you to focus on achieving your home ownership dreams.

Beyond securing your initial mortgage, a skilled broker offers invaluable support managing your loan through changing economic landscapes and personal circumstances. As your financial situation evolves, your broker can guide you through options that best suit your needs. Here’s how they assist:

Utilize their expertise to make sure your mortgage continues to work for you.

Buying a home is likely to be one of the biggest financial decisions you’ll make. And in New Zealand’s dynamic property market, getting expert advice from a mortgage broker can be invaluable in securing the right home loan for your needs. But with hundreds of mortgage brokers out there, how do you choose the right one? Here are some key factors to consider:

It’s also wise to look for a broker with several years of experience in the New Zealand mortgage market. The lending landscape is constantly changing, so you want someone who keeps up with the latest products, interest rates, regulations and trends to give you well-informed advice.

Ideally, look for a broker who can access at least 10-15 different banks and non-bank lenders, including the major players like ANZ, ASB, BNZ and Westpac. This will give you a wider selection of loan options. Keep in mind though that brokers can’t access every lender – for example, Kiwibank only offers home loans directly.

Consider your own situation and whether a broker has dealt with similar borrowers before. A first home buyer has very different needs to an experienced investor expanding their portfolio, for instance. The more a broker understands your specific circumstances, the better they can assist you.

Look for a broker who offers your preferred communication methods, whether that’s face-to-face meetings, phone calls, email or text. And make sure they have the capacity to give your application the attention it deserves – an overloaded broker may not be as proactive as you need.

You can also check a broker’s membership in professional bodies like the New Zealand Mortgage Brokers Association or the New Zealand Financial Advice Network. These organizations have codes of conduct that require members to act with integrity and professionalism.

Always ask upfront about a broker’s fee and commission structures so you know what to expect. Keep in mind that brokers are legally required to disclose any commissions they receive and act in your best interests when recommending a loan, thanks to the recent changes under the Financial Services Legislation Amendment Act.

Choosing the right mortgage broker is a decision that can have a long-term impact on your finances. By considering factors like qualifications, lender panel, specialization, service, reputation and fees, you’ll be well placed to find a broker who can help you navigate New Zealand’s mortgage market with expertise and care.

To guarantee you’re making the best decision, ask your mortgage broker these essential questions during your initial consultation.

These questions will help you assess the broker’s capabilities and commitment to client satisfaction, guiding you to make an informed decision tailored to your needs.

Deciding whether to use a mortgage broker depends heavily on your specific financial circumstances and personal preferences. Evaluating your borrower needs against the broker benefits can offer clarity. A broker’s role is to serve as your advocate, guiding through the complexities of the mortgage process. They can source multiple loan options, helping to secure terms that might be more favorable than what you could find on your own.

The broker services extend beyond merely finding rates; they provide personalized guidance and support, handling paperwork and negotiations. This can be particularly advantageous if you’re pressed for time or unfamiliar with the financial intricacies of loan agreements. Borrower benefits also include the potential for cost savings on interest rates and fees, as brokers have access to a broader array of products than a single lender might offer.

However, weigh these advantages against the cons. Brokers may have fees that could offset the savings achieved on your mortgage. It’s important to ask questions and seek clarification to make sure their services align with your financial goals. Don’t hesitate to compare the terms from direct lenders alongside those your broker presents. This informed approach will help you make a decision that best suits your financial landscape.

Mortgage broker fees typically include service charges, broker compensation, and upfront costs. Fee structures vary, offering different payment options. You’ll find this flexibility aligns with your financial planning for securing the best mortgage terms.

Yes, mortgage brokers can negotiate loan terms. They leverage lender relationships and rate comparisons to devise customized strategies, enhancing your approval odds and potentially reducing your closing costs. It’s a strategic move for your financing.

Mortgage brokers provide tailored solutions after a thorough credit analysis. They’ll offer broker advice on credit improvement and connect you with a variety of lenders best suited to handle your specific credit issues.

Yes, mortgage brokers are regulated and licensed. They must meet strict broker training requirements, undergo compliance audits, and renew their licenses regularly, ensuring they stay accredited by recognized regulatory bodies.

If you’re unhappy with your broker’s service, explore broker replacement options, understand service dissatisfaction causes, and learn complaint filing procedures. Evaluate brokers against set criteria and consider alternative service sources for better satisfaction.

To sum up, a mortgage broker can be your gateway to better loan options with less hassle. They’ll navigate the complex mortgage landscape, guaranteeing you secure the best rates and terms suited to your needs.

When choosing a broker, inquire about their experience, fees, and lender options to establish transparency and trust. Ultimately, using a mortgage broker could save you time and money, making it a prudent choice for your financial future.

Consider your needs and make an informed decision.

Have you ever wondered why your bank might require you to lower your credit card limit and closing your buy now, pay later (BNPL) accounts like Afterpay and Laybuy? In this article, we delve into the reasons behind this recommendation and shed light on its impact on your financial journey, particularly when applying for a home loan.

Credit cards and BNPL schemes undoubtedly offer convenience and perks for everyday transactions, but it’s crucial to recognize that financial institutions view these as liabilities. This perspective can significantly influence the amount you’re eligible to borrow when seeking a home loan.

The dilemma arises for those who manage their credit cards and BNPL accounts responsibly – paying off balances monthly and avoiding interest charges. Despite these sound financial practices, banks still perceive the full credit card limit and active BNPL accounts as potential liabilities. This directly influences the serviceability assessment, a pivotal factor in mortgage approval.

While maintaining higher credit card limits and open BNPL accounts might provide a sense of security, it’s essential to realise that this can lead to unintended consequences when applying for a home loan. The seemingly unused credit cushion could actually hinder your borrowing capacity and result in unfavorable loan terms.

In many instances, lenders or your mortgage advisor will recommend either reducing your credit card limit or closing certain BNPL accounts. However, it’s essential to know that you’re not obligated to adhere to these suggestions. The decision to lower limits or close accounts should be aligned with your financial strategy and long-term goals.

Your credit card limit isn’t a fixed thing, and BNPL accounts can be managed based on your requirements. Once your home loan is secured, you can reconsider utilising these options as needed.

In conclusion, the relationship between credit limits, buy now pay later accounts, and mortgage applications is a complicated one. It’s essential to strike a balance between leveraging credit for convenience and ensuring that your financial decisions align with your home ownership aspirations.