Menu

Purchasing a home is one of the most significant financial decisions you’ll make in your lifetime. Whether you’re a first-time homebuyer or refinancing your existing mortgage, securing a mortgage in New Zealand can be a complex and daunting process. While many are excited about the prospect of homeownership, mistakes in the mortgage application process can delay approval or, worse, lead to rejection. Understanding and avoiding these common pitfalls will help you streamline the process and ensure you get the best deal.

By being aware of these missteps, you can make informed decisions and increase your chances of a smooth and successful mortgage application process.

Your credit score is one of the most important factors that lenders use to determine your eligibility for a mortgage. It’s essentially a reflection of your financial health, showing how responsible you’ve been with managing credit and debt. The higher your credit score, the more favorable your mortgage terms will be, including lower interest rates.

However, many homebuyers in New Zealand fail to check their credit score before applying for a mortgage. This is a critical mistake because any issues with your credit report could negatively impact your ability to secure a loan. For example, outstanding debts, missed payments, or even errors on your credit report can lower your score and affect your mortgage approval chances.

Having a good credit score demonstrates to lenders that you’re a low-risk borrower, which means they’re more likely to approve your application and offer you better loan terms.

Many first-time buyers make the mistake of accepting the first mortgage offer they receive. However, mortgage rates can vary significantly across lenders, and even a small difference in interest rates can have a huge impact on your long-term payments.

New Zealand’s mortgage market offers a variety of options, from fixed-rate to floating-rate loans. Failing to shop around for the best rates could result in you paying more over the life of the loan.

Securing a mortgage with a competitive interest rate can save you thousands of dollars over the life of your loan. It’s worth investing time in comparing offers to ensure you get the most affordable option for your needs.

In New Zealand, most lenders require a deposit or equity as part of the mortgage application process. This deposit represents your share of the home’s value and is typically between 10% to 20% of the purchase price, although some lenders may accept as low as 5% for certain buyers (such as first-time homebuyers or those with a good credit history).

Many applicants make the mistake of underestimating the importance of having a solid deposit saved up. A small deposit could limit your mortgage options and lead to higher interest rates. On the other hand, a larger deposit will demonstrate your ability to manage money and may result in a lower loan-to-value ratio (LVR), improving your chances of mortgage approval.

A substantial deposit reduces the amount you need to borrow, which can improve your chances of securing a mortgage with favorable terms. It can also help you avoid costly LVR restrictions and Lender’s Mortgage Insurance (LMI) fees.

Your debt-to-income ratio (DTI) is a key factor that lenders use to assess your ability to manage additional debt. This ratio is calculated by dividing your total monthly debt payments by your gross monthly income. A high DTI ratio means that you’re already carrying a large amount of debt relative to your income, which can raise red flags for lenders.

Lenders in New Zealand typically prefer a DTI of 40% or lower when considering mortgage applications. If your DTI is too high, it can hinder your chances of getting approved for a mortgage, or result in you being offered a smaller loan amount.

Keeping your debt-to-income ratio low shows lenders that you have the financial capacity to handle additional debt and can make your mortgage repayments on time. This makes you a more attractive candidate for loan approval.

One of the most common mistakes is not being completely transparent about your financial situation when applying for a mortgage. Lenders rely on accurate and complete information to assess your application, and any discrepancies or hidden debts could result in delays, denials, or even legal consequences.

Honesty and transparency ensure that your mortgage application is processed efficiently. Lenders will appreciate your openness, which can lead to a quicker approval and more favorable loan terms.

The process of applying for a mortgage in New Zealand can seem overwhelming, but with the right preparation and knowledge, you can avoid the common mistakes that often lead to delays or rejection. By checking your credit score, shopping around for the best rates, understanding the importance of a solid deposit, keeping your debt-to-income ratio low, and being transparent with your lender, you’ll increase your chances of securing the right mortgage for your needs.

If you’re ready to begin the mortgage application process or need expert advice, Best Mortgage Brokers is here to help. We can guide you through each step, ensuring you avoid these common pitfalls and secure the best deal possible.

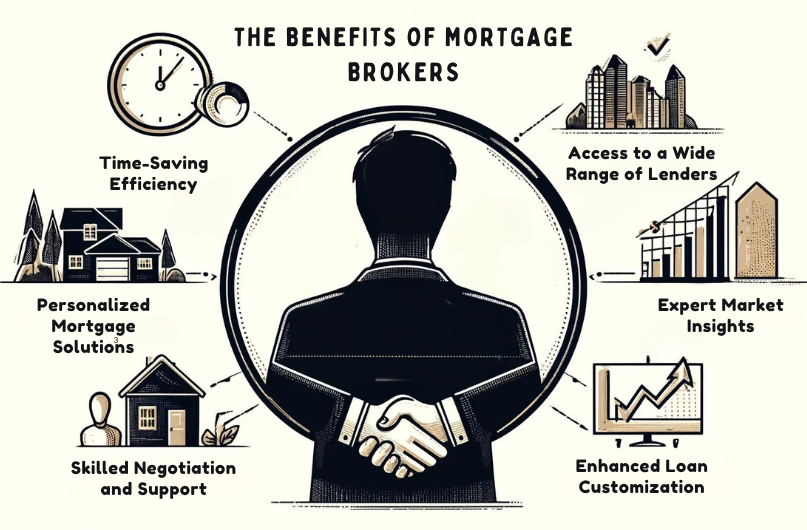

Using a mortgage broker can greatly simplify your home buying process in New Zealand. They handle the communication with lenders, manage all the necessary paperwork, and provide expert advice tailored to your financial situation. Mortgage brokers have access to a wide range of mortgage products and can secure the best deal for you, saving you time and potentially reducing costs. They’re regulated professionals, ensuring transparency and integrity throughout the process. With their in-depth knowledge and industry expertise, brokers guide you through complex mortgage scenarios and advocate on your behalf. Find out more about how a mortgage broker can be a strategic partner in achieving your homeownership goals.

A mortgage broker is a financial expert who helps you navigate through the intricate world of home loans by acting as an intermediary between you and potential lenders. Their qualifications typically include certifications and a strong understanding of financial markets, tailored especially to navigate the diverse mortgage landscape efficiently.

Brokers are subject to stringent industry regulations, ensuring they operate with integrity and transparency. This regulatory framework is designed to protect you by ensuring brokers uphold high standards of practice. As they foster broker relationships with a variety of lenders, they can access a broader array of mortgage products. This means they can offer you tailored options that best meet your financial situation.

Their primary responsibilities involve evaluating your financial circumstances, finding appropriate mortgage options, and assisting throughout the application and settlement processes. This extensive service simplifies your experience, making it less stressful and potentially more cost-effective. By leveraging their expertise, you’re better equipped to make informed decisions in securing the most advantageous mortgage deal.

When you choose to work with a mortgage broker in New Zealand, you’re not just gaining a professional ally; you’re also accessing a vast array of loan products that mightn’t be available through traditional banks. They’re legally required to find you the best deal, ensuring that your financial interests are always the top priority.

Additionally, brokers can greatly reduce the time and effort you need to invest in the mortgage process, guiding you expertly through even the most complex applications.

Mortgage brokers in New Zealand, regulated by the Financial Markets Authority (FMA), must legally secure the best mortgage deal for you, guaranteeing your interests are prioritized. This legal obligation isn’t just a formality—it’s a significant client advantage that places broker’s accountability at the forefront of their service.

Unlike banks, whose primary aim might be to sell their own products, your broker’s duty is aligned with your financial benefits. This framework of consumer protection ensures you aren’t simply settling for a convenient option but are getting the most advantageous deal available.

This commitment to your financial well-being is crucial in navigating the often-complex landscape of mortgage options, giving you peace of mind and potentially saving you a significant amount of money.

A mortgage broker can provide you with an extensive selection of products from various lenders, greatly enhancing your options for securing the best mortgage tailored to your needs. By engaging in thorough market research, they can offer you a detailed product comparison, laying out the pros and cons of each option.

This range of lender options guarantees you aren’t limited to the offerings of a single financial institution. Instead, you receive tailored advice that aligns with your unique financial circumstances and goals. Brokers’ deep understanding of diverse financial solutions translates into optimized mortgage strategies for you.

Their expertise allows them to navigate the complexities of mortgage products, ensuring you make an informed decision that benefits your long-term financial health.

By choosing to work with a mortgage broker in New Zealand, you’ll greatly reduce the time and effort needed to sift through numerous mortgage options on your own. This choice offers significant time-saving benefits and efficiency advantages, streamlining your path to the right mortgage. Here’s how a broker simplifies the process:

Mortgage brokers turn a challenging task into a manageable journey.

Engaging a mortgage broker offers you expert advice and personalized service that’s tailored to your unique financial situation. Brokers possess deep industry knowledge, enabling them to illuminate the path through an array of financial options, ensuring you understand every step.

For first-time buyers or those in intricate financial scenarios, this guidance is invaluable. They provide customized solutions that resonate with your specific needs, making complex decisions simpler.

Dealing with intricate mortgage applications often requires expert assistance, and mortgage brokers are ideally positioned to help. When you’re maneuvering through complex financial waters, such as leveraging KiwiSaver funds or involving family contributions, brokers offer invaluable support through their financial expertise. Here’s how they can assist you:

Utilize a broker’s skills to improve your chances of securing the right mortgage.

One of the most appealing advantages of working with a mortgage broker is that their services are typically free for you, as they earn their commission directly from the lender. This setup not only facilitates cost savings but also boosts your financial freedom.

By leveraging their expert advice, you’re tapping into deep market knowledge without the burden of additional fees. Brokers provide personalized service, tailoring their approach to meet your specific financial circumstances and goals. Their expertise allows them to navigate complex market conditions, ensuring that you receive the best possible terms on your mortgage.

Essentially, choosing a broker can lead to significant savings and a smoother, more efficient mortgage process, allowing you to focus on achieving your home ownership dreams.

Beyond securing your initial mortgage, a skilled broker offers invaluable support managing your loan through changing economic landscapes and personal circumstances. As your financial situation evolves, your broker can guide you through options that best suit your needs. Here’s how they assist:

Utilize their expertise to make sure your mortgage continues to work for you.

Buying a home is likely to be one of the biggest financial decisions you’ll make. And in New Zealand’s dynamic property market, getting expert advice from a mortgage broker can be invaluable in securing the right home loan for your needs. But with hundreds of mortgage brokers out there, how do you choose the right one? Here are some key factors to consider:

It’s also wise to look for a broker with several years of experience in the New Zealand mortgage market. The lending landscape is constantly changing, so you want someone who keeps up with the latest products, interest rates, regulations and trends to give you well-informed advice.

Ideally, look for a broker who can access at least 10-15 different banks and non-bank lenders, including the major players like ANZ, ASB, BNZ and Westpac. This will give you a wider selection of loan options. Keep in mind though that brokers can’t access every lender – for example, Kiwibank only offers home loans directly.

Consider your own situation and whether a broker has dealt with similar borrowers before. A first home buyer has very different needs to an experienced investor expanding their portfolio, for instance. The more a broker understands your specific circumstances, the better they can assist you.

Look for a broker who offers your preferred communication methods, whether that’s face-to-face meetings, phone calls, email or text. And make sure they have the capacity to give your application the attention it deserves – an overloaded broker may not be as proactive as you need.

You can also check a broker’s membership in professional bodies like the New Zealand Mortgage Brokers Association or the New Zealand Financial Advice Network. These organizations have codes of conduct that require members to act with integrity and professionalism.

Always ask upfront about a broker’s fee and commission structures so you know what to expect. Keep in mind that brokers are legally required to disclose any commissions they receive and act in your best interests when recommending a loan, thanks to the recent changes under the Financial Services Legislation Amendment Act.

Choosing the right mortgage broker is a decision that can have a long-term impact on your finances. By considering factors like qualifications, lender panel, specialization, service, reputation and fees, you’ll be well placed to find a broker who can help you navigate New Zealand’s mortgage market with expertise and care.

To guarantee you’re making the best decision, ask your mortgage broker these essential questions during your initial consultation.

These questions will help you assess the broker’s capabilities and commitment to client satisfaction, guiding you to make an informed decision tailored to your needs.

Deciding whether to use a mortgage broker depends heavily on your specific financial circumstances and personal preferences. Evaluating your borrower needs against the broker benefits can offer clarity. A broker’s role is to serve as your advocate, guiding through the complexities of the mortgage process. They can source multiple loan options, helping to secure terms that might be more favorable than what you could find on your own.

The broker services extend beyond merely finding rates; they provide personalized guidance and support, handling paperwork and negotiations. This can be particularly advantageous if you’re pressed for time or unfamiliar with the financial intricacies of loan agreements. Borrower benefits also include the potential for cost savings on interest rates and fees, as brokers have access to a broader array of products than a single lender might offer.

However, weigh these advantages against the cons. Brokers may have fees that could offset the savings achieved on your mortgage. It’s important to ask questions and seek clarification to make sure their services align with your financial goals. Don’t hesitate to compare the terms from direct lenders alongside those your broker presents. This informed approach will help you make a decision that best suits your financial landscape.

Mortgage broker fees typically include service charges, broker compensation, and upfront costs. Fee structures vary, offering different payment options. You’ll find this flexibility aligns with your financial planning for securing the best mortgage terms.

Yes, mortgage brokers can negotiate loan terms. They leverage lender relationships and rate comparisons to devise customized strategies, enhancing your approval odds and potentially reducing your closing costs. It’s a strategic move for your financing.

Mortgage brokers provide tailored solutions after a thorough credit analysis. They’ll offer broker advice on credit improvement and connect you with a variety of lenders best suited to handle your specific credit issues.

Yes, mortgage brokers are regulated and licensed. They must meet strict broker training requirements, undergo compliance audits, and renew their licenses regularly, ensuring they stay accredited by recognized regulatory bodies.

If you’re unhappy with your broker’s service, explore broker replacement options, understand service dissatisfaction causes, and learn complaint filing procedures. Evaluate brokers against set criteria and consider alternative service sources for better satisfaction.

To sum up, a mortgage broker can be your gateway to better loan options with less hassle. They’ll navigate the complex mortgage landscape, guaranteeing you secure the best rates and terms suited to your needs.

When choosing a broker, inquire about their experience, fees, and lender options to establish transparency and trust. Ultimately, using a mortgage broker could save you time and money, making it a prudent choice for your financial future.

Consider your needs and make an informed decision.

Have you ever wondered why your bank might require you to lower your credit card limit and closing your buy now, pay later (BNPL) accounts like Afterpay and Laybuy? In this article, we delve into the reasons behind this recommendation and shed light on its impact on your financial journey, particularly when applying for a home loan.

Credit cards and BNPL schemes undoubtedly offer convenience and perks for everyday transactions, but it’s crucial to recognize that financial institutions view these as liabilities. This perspective can significantly influence the amount you’re eligible to borrow when seeking a home loan.

The dilemma arises for those who manage their credit cards and BNPL accounts responsibly – paying off balances monthly and avoiding interest charges. Despite these sound financial practices, banks still perceive the full credit card limit and active BNPL accounts as potential liabilities. This directly influences the serviceability assessment, a pivotal factor in mortgage approval.

While maintaining higher credit card limits and open BNPL accounts might provide a sense of security, it’s essential to realise that this can lead to unintended consequences when applying for a home loan. The seemingly unused credit cushion could actually hinder your borrowing capacity and result in unfavorable loan terms.

In many instances, lenders or your mortgage advisor will recommend either reducing your credit card limit or closing certain BNPL accounts. However, it’s essential to know that you’re not obligated to adhere to these suggestions. The decision to lower limits or close accounts should be aligned with your financial strategy and long-term goals.

Your credit card limit isn’t a fixed thing, and BNPL accounts can be managed based on your requirements. Once your home loan is secured, you can reconsider utilising these options as needed.

In conclusion, the relationship between credit limits, buy now pay later accounts, and mortgage applications is a complicated one. It’s essential to strike a balance between leveraging credit for convenience and ensuring that your financial decisions align with your home ownership aspirations.

During the 2020-2022 period, I helped many first homebuyers achieve their dream of getting on the property ladder. I love my job, and it makes me super happy to see Kiwis get out from under a landlord and into their own home. First home buyers are my favourite – I love to educate them and give them the benefit of my many years lending and property investment experience.

Sadly, however, I had some clients over that period that struggled to make the leap into home ownership. Not because they didn’t have a bank approval – but because they procrastinated……

And the end result was that they went backwards financially.

One such couple who lost focus on their goal, lost 20% buying power over that 2 year period, when they could’ve bought a really nice property, but didn’t. Interest rates went up, their loan affordability went down, and over the 2 years, the property price range they were shopping in reduced dramatically – until finally they needed parental help to get into a property, that they could’ve bought on their own if they’d acted 18 months earlier.

Often first home buyers are nervous. It is a big commitment ! They are worried about something going wrong, and not being able to meet their repayments. And that can happen – none can see the future. But we can protect ourselves as much as possible – your adviser will help you put structures in place to guard against the unexpected. Also, banks rigorously test an application’s debt servicing – the last thing a bank wants, is to see their loan fail, so they build fat into the calculations to minimise the risk.

Sometimes first home buyers are worried about paying too much – maybe if they wait a few months, the price will get lower. The truth ? If you are hopping on the property ladder for life – it doesn’t matter at all, what you pay. In 20 or 50 years – it just won’t matter. Even if you sell that property after 5 years and buy another. Doesn’t matter ! Buying and selling in the same market. The only time it is critical, is if you are speculating – planning to hold it for a short time only, then sell for profit. That’s something to keep away from unless you have a solid financial base, a lot of experience, and a big risk appetite.

Finally, first home buyers can be disappointed at the properties in their price range. They might be comparing with their parent’s home, or they are dreaming of a cottage with an oak tree and a swing……………Reality check – your first home does not have to be your dream home. It will probably not be your forever home. But you can make your mark on it, and it will get you on the ladder, and you can aim for something better down the track.

Just avoid houses that have not been maintained and will need expensive work done – like a re-roof – unless you have the savings put aside. Also steer clear of non-complying works – plenty of that in Northland.

If you are reading the commentary coming from various economists right now, indications are that we have probably hit the bottom of the property cycle, which means prices may start to rise from late this year. Don’t get caught napping like others did in the last cycle.

The best thing you can do at the start of your home ownership journey, is get a good adviser working with you. Someone to answer your questions, and keep you motivated and on track.