Menu

Buying a home is one of the biggest financial decisions you’ll make in your life. For most Kiwis, that means taking out a mortgage to finance their dream property. But with so many lending options and complex terms to navigate, the process can feel overwhelming. That’s where a skilled mortgage broker comes in.

A good mortgage broker acts as your guide and advocate, helping you secure the most favourable home loan for your unique situation. However, not all brokers are created equal. To ensure you partner with a professional who has your best interests at heart, there are several key things to look for.

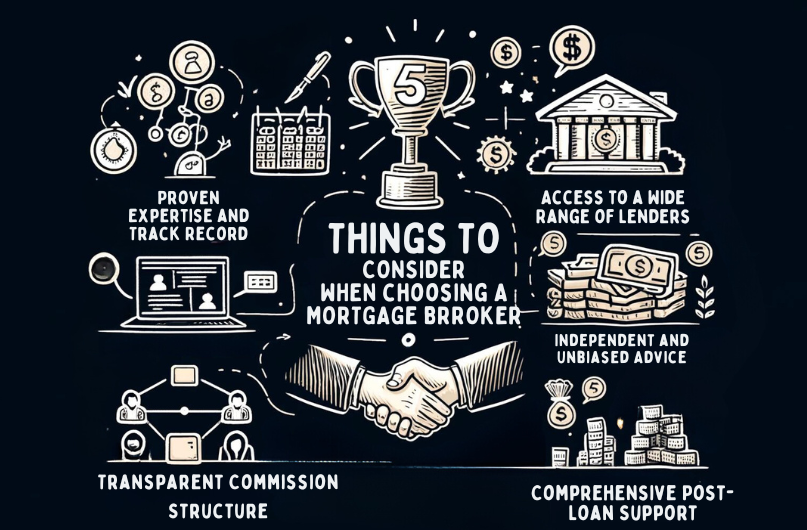

In this article, we’ll walk you through the five most important factors to consider when choosing a mortgage broker in New Zealand. From their qualifications and lender networks to their independence and ongoing support, we’ll cover what you need to know to make a confident, informed decision.

By taking the time to carefully vet potential brokers using these criteria, you’ll be well on your way to securing a competitive mortgage that sets you up for long-term financial success. Let’s dive in and explore each of these critical considerations in more detail.

When choosing a mortgage broker, it’s crucial to assess their experience and qualifications to ensure they can guide you through the intricate process effectively. Understanding expertise begins with examining their track record. A broker with a history of successful mortgage applications is more likely to grasp the intricacies and requirements of different lenders, which can greatly boost your chances of approval.

When assessing credibility, consider the broker’s longevity in the industry. This isn’t just about the years; it’s about the depth of experience they’ve acquired and how they’ve adapted to changing regulations and market conditions. A seasoned broker can offer insights and solutions that less experienced brokers mightn’t even be aware of.

Furthermore, prioritize brokers who’ve consistently secured approvals. This indicates not only their proficiency in handling typical cases but also their ability in navigating complex scenarios. Opting for a broker with a strong approval history can provide you with a smoother, more predictable mortgage application process.

In essence, a mortgage broker’s qualifications and experience are crucial in achieving a tailored and successful mortgage solution. Make sure you’re entrusting your financial future to someone who’s proven their ability to handle it with expertise and integrity.

Drawing on the significance of a broker’s experience, their range of lender relationships is equally vital in securing a mortgage that best fits your needs. A broker with a wide array of lender options can offer customized solutions that align precisely with your financial situation. This variety guarantees that you aren’t restricted to generic products but have access to specialized mortgage plans that cater specifically to your unique circumstances.

Mortgage brokers with extensive broker connections are more skilled at maneuvering through the landscape of market rates. This ability to tap into a diverse network boosts their capability to secure competitive rates, ensuring you receive the most cost-effective mortgage options. Their established relationships with various lenders mean they can often negotiate better terms on your behalf, potentially saving you significant amounts of money over the life of your mortgage.

Furthermore, the flexibility offered by having access to multiple lenders proves invaluable, especially if you have specific requirements or face unique financial challenges. This diversity allows your broker to more effectively match you with a lender who not only meets but anticipates and accommodates your particular needs. Ultimately, the breadth and depth of a broker’s lender relationships can significantly influence the quality and suitability of your mortgage options.

Understanding the contrast between independent and affiliated mortgage brokers is crucial as it impacts the variety and impartiality of the mortgage options available to you. Independent brokers can provide you with unbiased advice because they aren’t tied to any specific lenders. This lack of conflict of interest means they’re free to explore a wider range of products, ensuring that the recommendations you receive are tailored to your unique financial needs.

On the other hand, affiliated brokers often face lender restrictions that can limit your options. These restrictions could mean that you’re not seeing a full spectrum of available mortgage products, potentially missing out on deals better suited to your situation.

Here are some key points to keep in mind:

Now that you know about the differences between independent and affiliated brokers, let’s explore how mortgage brokers get paid and the impact this has on your mortgage choices. Understanding the payment and commission structures is important for making informed decisions.

Mortgage brokers typically earn their income through commissions from banks, roughly amounting to 1% of the loan amount. For instance, on a $500,000 mortgage, a broker might receive a $5,000 commission. This similarity to travel agents’ earnings model means that you don’t directly pay fees to brokers; instead, their compensation comes from the lenders.

Commission transparency is vital. You should be aware of how your broker is compensated to ensure that the recommendations made are in your best interest rather than influenced by potential higher commissions from certain lenders. It’s also worth noting that some brokers might offer incentives like discounted interest rates or cash-back which can seem appealing but should be carefully evaluated against other loan features.

Understanding these payment options allows you to assess the full scope of what you’re being offered. Always inquire about how your broker is paid. This knowledge helps you gauge the impartiality of the advice you’re receiving, ensuring that your choice is truly the best for your financial situation.

After completing your mortgage, it’s important to select a broker who provides extensive post-loan assistance and services. This ongoing support is vital for effective financial planning and enhancing customer satisfaction. You’ll want a broker who isn’t just there at the beginning but stays with you, making sure that your mortgage management is as beneficial and streamlined as possible.

Choosing a mortgage broker who offers these post-loan services won’t only help you keep up with the dynamics of the housing market but also ensure you’re positioned well for any financial shifts. This level of support is vital in addressing post-loan challenges and opportunities, ultimately leading to a more controlled and satisfying mortgage management experience.

To choose your mortgage broker, verify their certification and local expertise first. You’ll want someone credible, with a proven track record and positive client feedback, ensuring they can tailor solutions to your needs.

To determine if a mortgage broker is good, check their credentials and seek out client testimonials. These indicators reflect their professionalism and effectiveness in securing favorable mortgage terms tailored to clients’ needs.

Don’t exaggerate your personal finances or use aggressive negotiation tactics with your mortgage broker. Misrepresentations can backfire, hindering your loan process. Always be straightforward to guarantee accurate advice and the best loan options.

When selecting a mortgage broker, make sure they have a solid track record and the right qualifications. A wide network of lenders can access better rates and options tailored to your needs. Choose an independent broker for impartial advice.

Understand their payment and commission structures to guarantee transparency. Don’t overlook the importance of thorough post-loan support.

By considering these factors, you’ll be well-equipped to find a broker who aligns with your financial goals and offers reliable guidance.